accumulated earnings tax form

These retained earnings which are not paid out to shareholders in the form of dividends appear in the shareholders equity section of the companys financial report. LoginAsk is here to help you access Accumulated Earnings Tax Form quickly and.

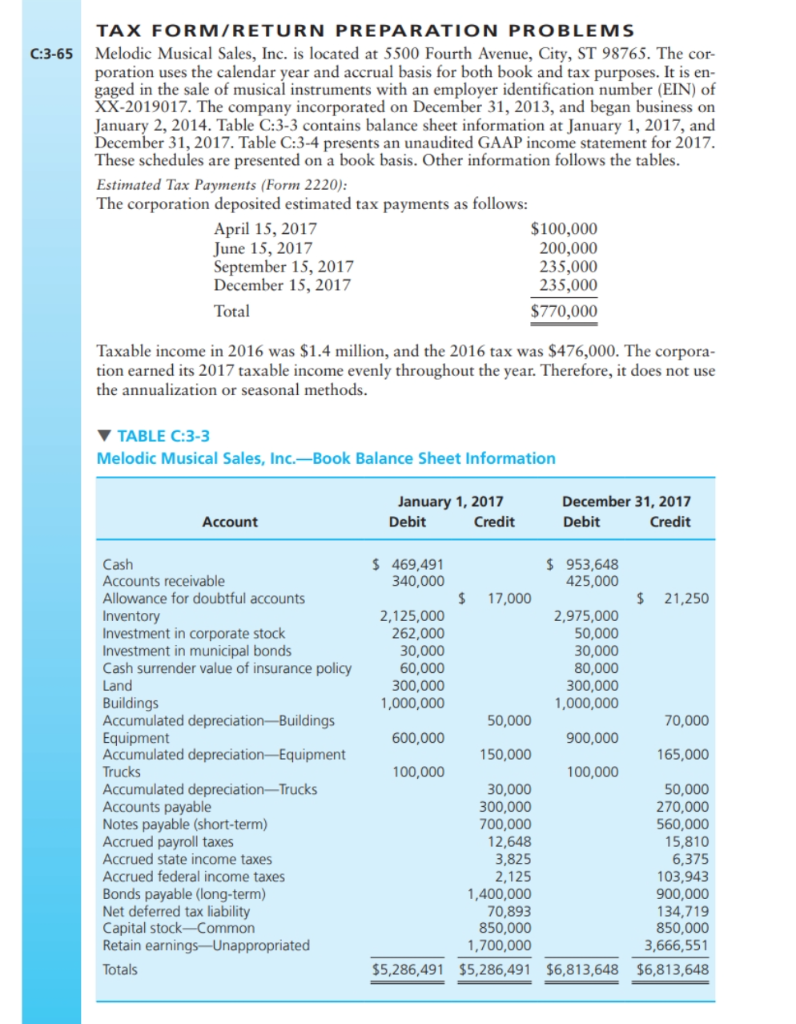

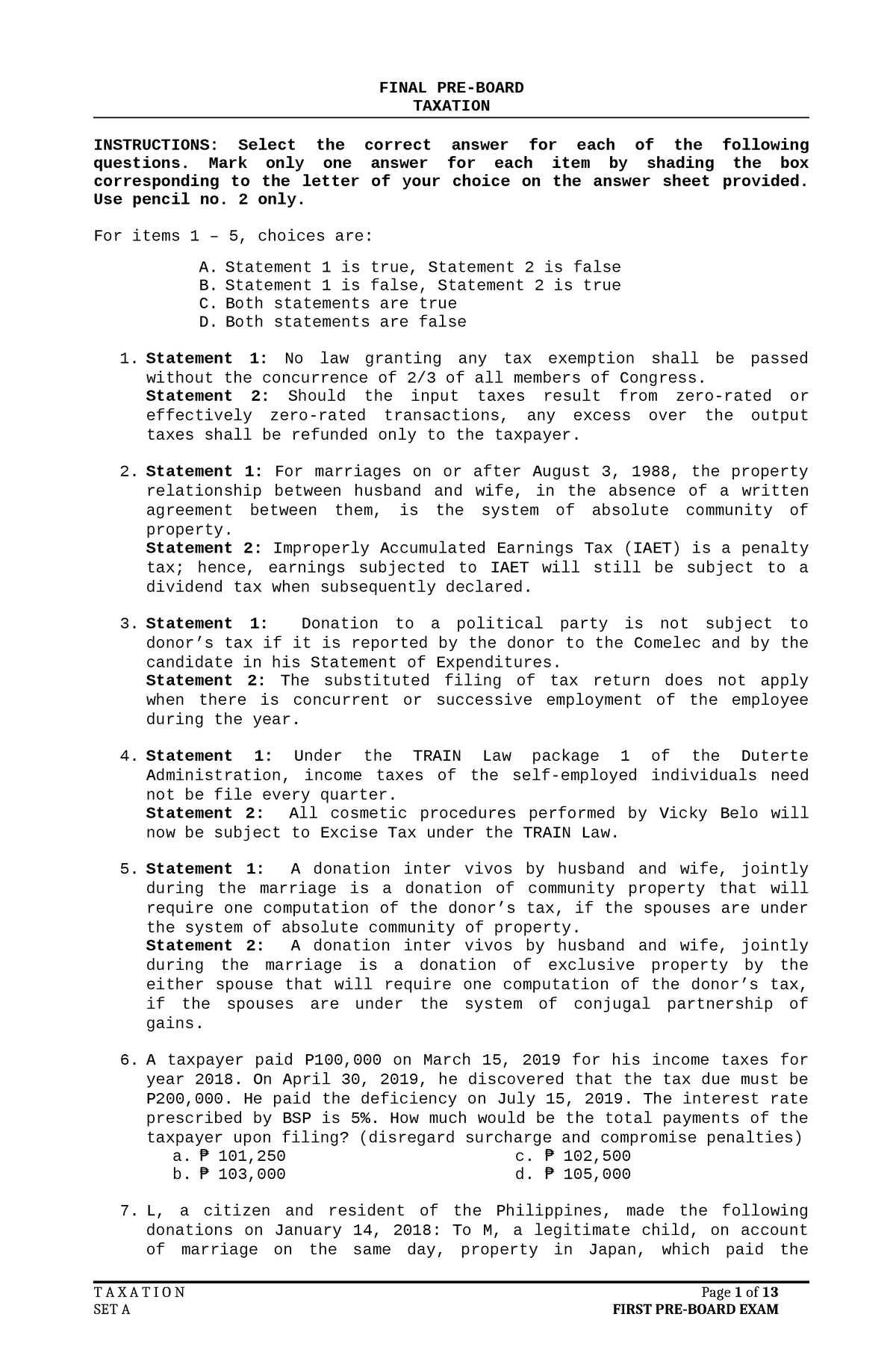

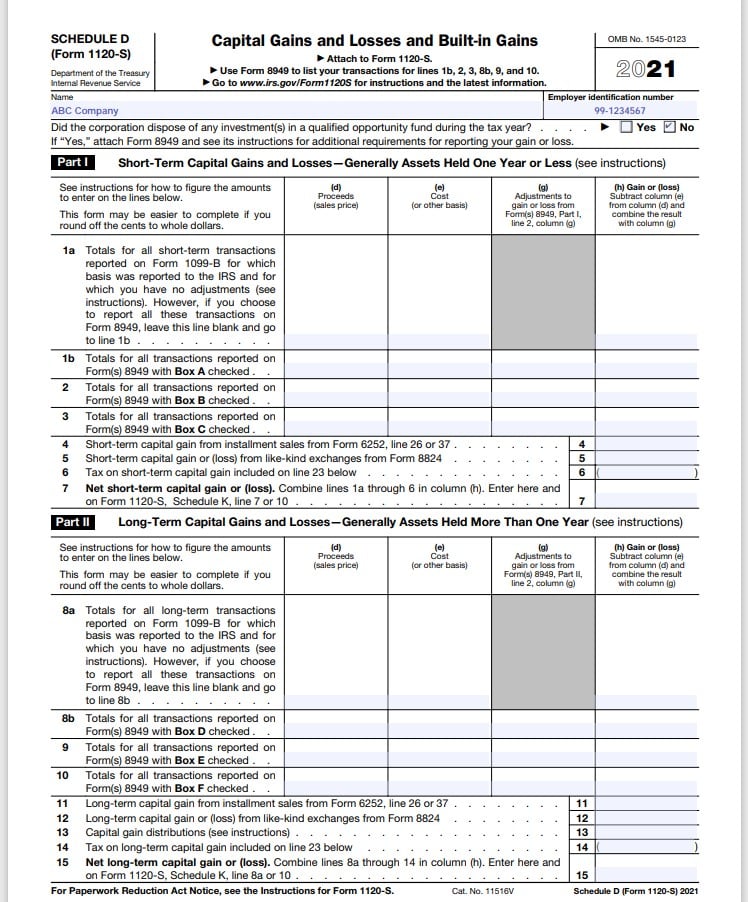

Please Complete The Schedule D Form At The Bottom Chegg Com

Streamlined Document Workflows for Any Industry.

. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. Publication 542 012019 Corporations - IRS tax forms.

Ad State-specific Legal Forms Form Packages for Consulting Services. Every domestic corporation branch of a foreign corporation. Read customer reviews find best sellers.

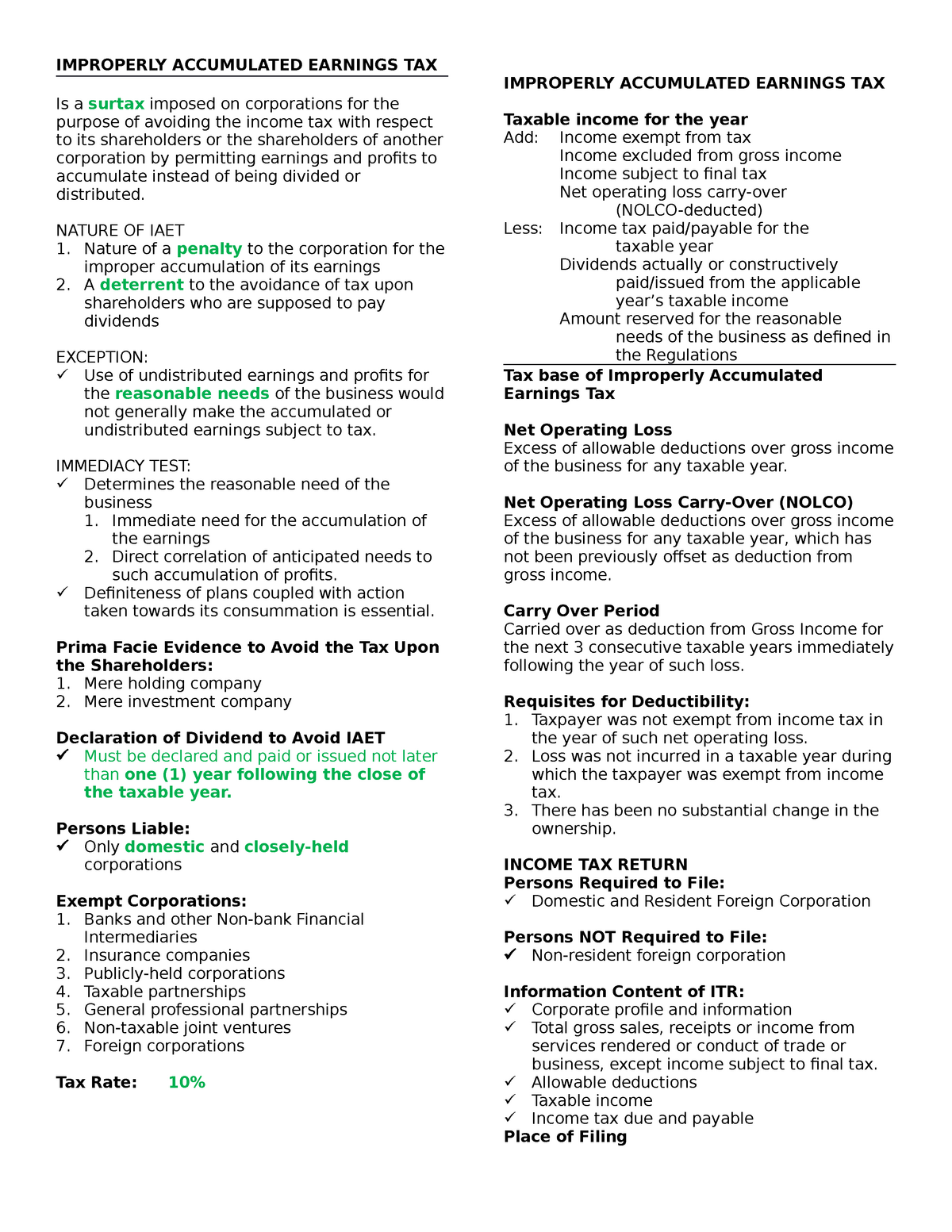

Accumulated Earnings Tax Form will sometimes glitch and take you a long time to try different solutions. The tax code imposes this penalty tax on C corporations with large accumulations of cash based upon the theory that companies holding. To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535.

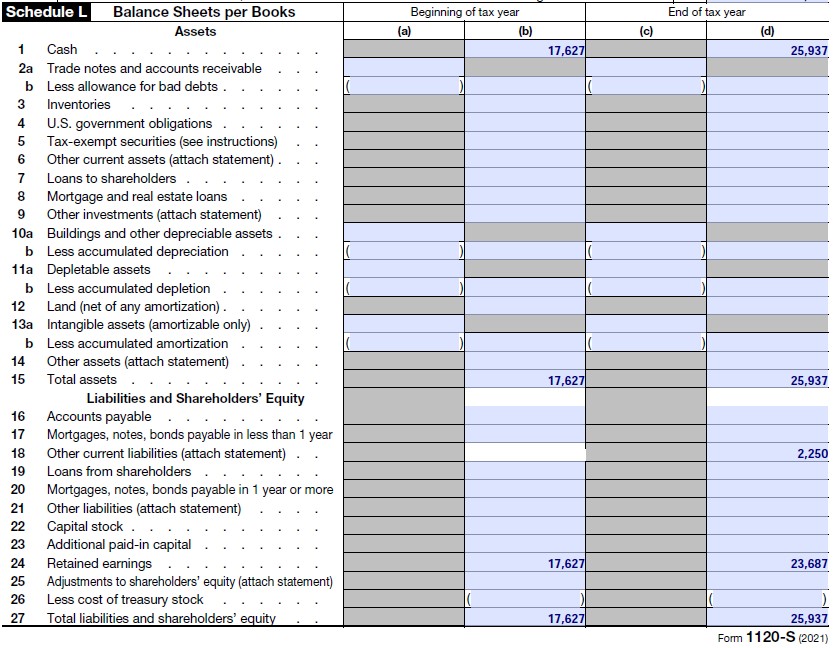

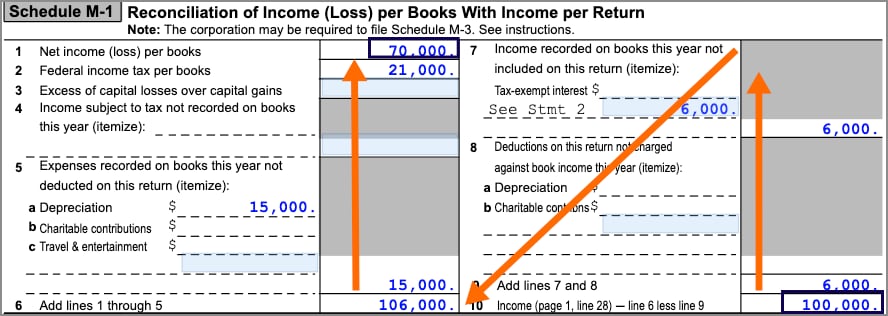

1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or Schedule M-3. Free Case Review Begin Online. Accumulated earnings and profits E P is an accounting term applicable to stockholders of corporations.

In January you use the worksheet in the Form 5452 instructions to figure your corporations current year earnings. However if a corporation allows earnings to accumulate. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

We will mail checks to qualified applicants. Accumulated earnings and profits are a companys net profits. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of.

Recently the Tax Court had an opportunity to consider the. Ad Based On Circumstances You May Already Qualify For Tax Relief. Form NJ-1040-H is a property tax credit application available to certain home-owners and tenants.

Ad Browse discover thousands of brands. Improperly Accumulated Earnings Tax IAET Return. If you are a New York State part-year resident you must file Form IT-203 Nonresident and Part-Year Resident Income Tax Return if you meet any of the following.

This property tax credit is only available on certain years - it has been suspended by. The accumulated earnings tax is a penalty tax. See If You Qualify For IRS Fresh Start Program.

The tax is in addition to the regular corporate income tax and is. Find Forms for Your Industry in Minutes. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary.

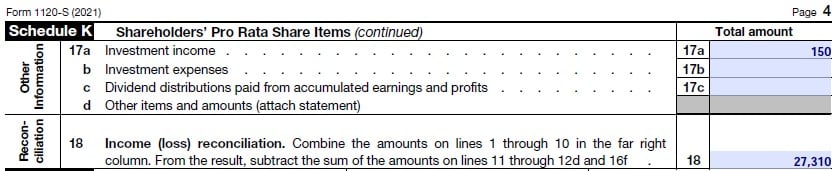

How To Complete Form 1120s Schedule K 1 With Sample

Improperly Accumulated Earnings Tax Improperly Accumulated Earnings Tax Is A Surtax Imposed On Studocu

Determining The Taxability Of S Corporation Distributions Part I

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Unappropriated Retained Earnings Meaning How Does It Work

Solved 8 A Closely Held Corporation Deemed Committed Unreasonably Accumulating Its Income Shows The Following Data Paid Up Capital P Course Hero

Cch Federal Taxation Comprehensive Topics Chapter 18 Accumulated Earning And Personal Holding Company Taxes C 2005 Cch Incorporated 4025 W Peterson Ave Ppt Download

Oct 2018 Final Preboard No Answer File File File File Final Pre Board Taxation Instructions Studocu

Demystifying Irc Section 965 Math The Cpa Journal

How To Complete Form 1120s Schedule K 1 With Sample

How To Complete Form 1120s Schedule K 1 With Sample

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

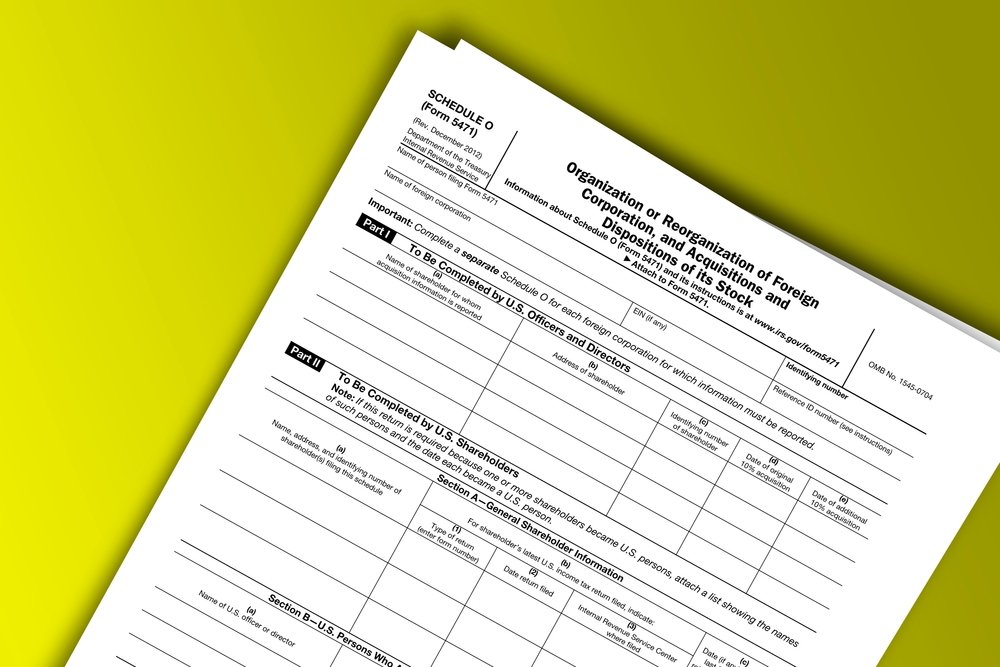

Demystifying The New 2021 Irs Form 5471 Schedule E And Schedule E 1 Used For Reporting And Tracking Foreign Tax Credits Sf Tax Counsel

How Is Retained Earnings Calculated On Form 1120

Improperly Accumulated Earnings Tax Ppt Fill Online Printable Fillable Blank Pdffiller

Solved An Scorporation May Owe Tax If At The End Of The Tax Chegg Com

Improperly Accumulated Earnings Tax Iaet Summary Of Corporate Income Taxation Youtube

Qc 5 3 Pdf Qc 5 3 Which Of The Following Corporate Forms Are Exempt From The Phc Tax The Accumulated Earnings Tax Corporate Form Exempt Or Course Hero

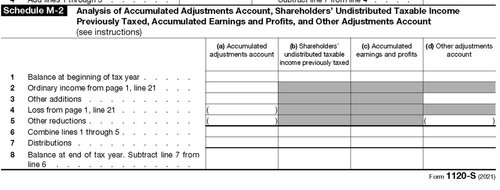

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments